![]()

The Fed elected to not increase the Federal Funds rate at the FOMC meeting on June 14, leaving the Target Rate at 5.00% – 5.25%.

- The central bank had previously raised rates 10 consecutive times in an effort to tamp down inflation.

- The move was widely expected by the market with CPI dropping to 4.0% in May, continuing a slow but gradual decline from 9.0% at its peak in June 2022.

- In its announcement, the Fed cautioned that it may still increase rates later in the year.

- The market views this as a “hawkish skip,” with the expectation that the Fed will still maintain a tightening bias towards another move higher in July.

The SOFR forward curve anticipates a steady decline to 3.75% by March of 2025 following a peak of 5.25% this September as Fed rate decreases are anticipated.

- Bank balance sheets remain weak as interest rates on deposits exceed average interest rates on existing loans and loan to deposit ratios are too high.

- Though the contagion from the spring banking crisis has subsided for now, the impact on liquidity in the real estate capital markets remains, leading to limited appetite for new loans and higher spreads.

- Treasuries have moved up sharply in the last month. The 5-year is at 3.93% and the 10-year is at 3.72%. Each up roughly 0.50% in the last 30 days.

- The economic outlook remains mixed. Manufacturing demand, energy futures, select corporate layoffs and other indicators point to a cooling economy. Concurrently, employment and consumer spending continue to be strong and equities markets have rallied with the S&P 500 Index entering a technical bull market up +20% from its October low.

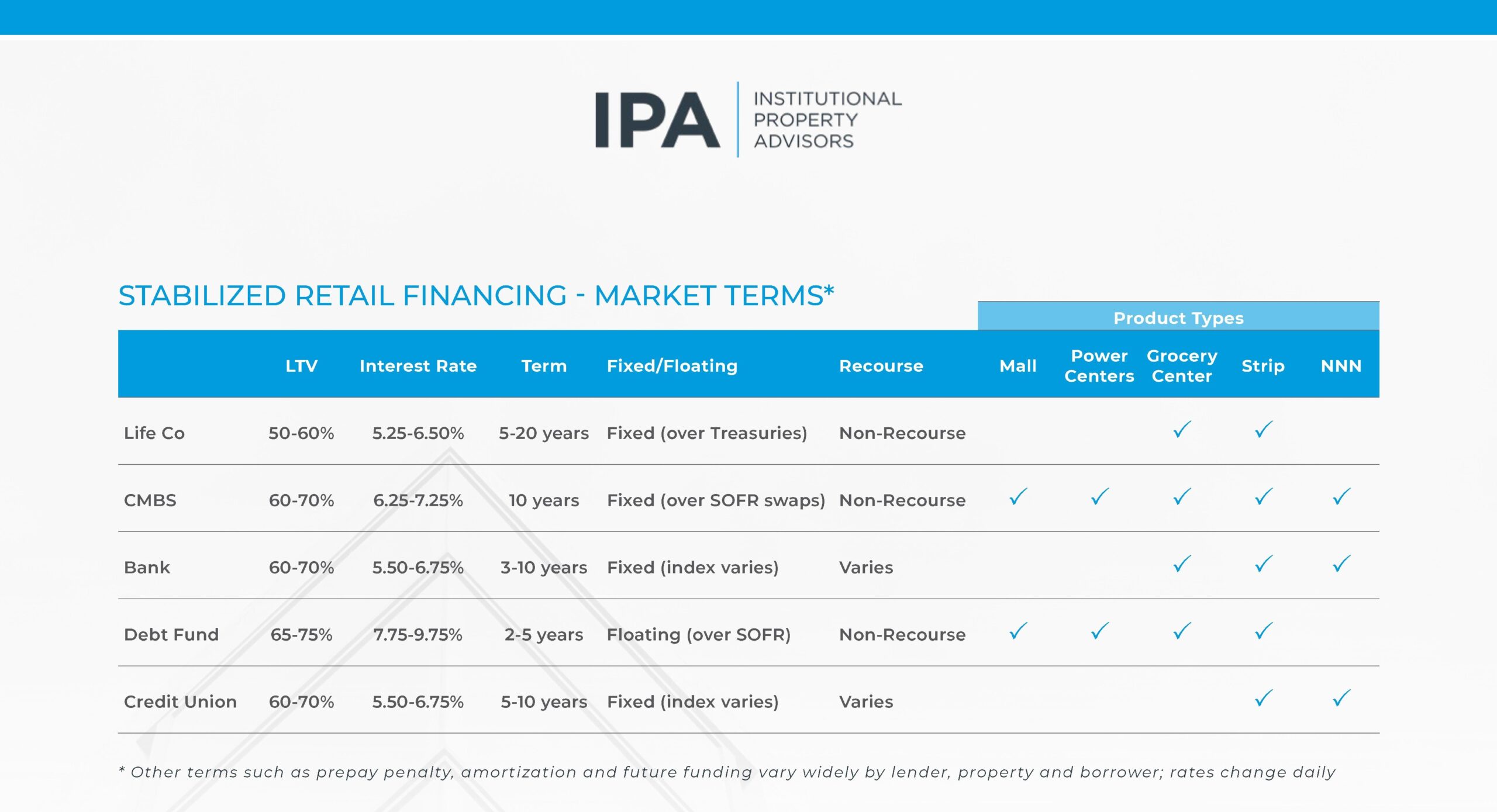

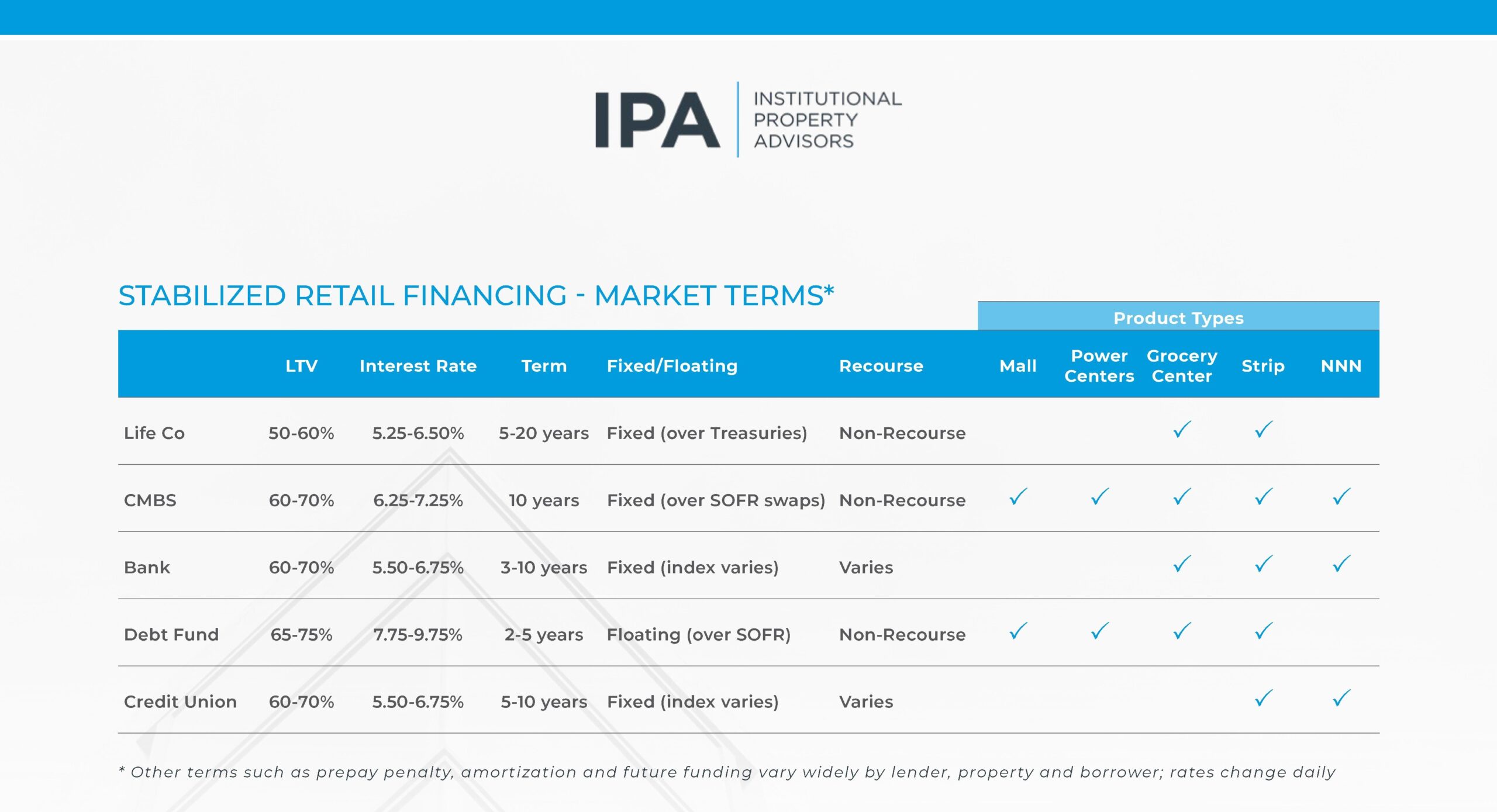

Banks, credit unions and life companies continue bidding on deals, albeit with a high level of caution and certain players on the sidelines.

- Bank and Credit Union lending rates range from 5.50% – 6.75% with leverage in the 60% – 70% LTV range. Many require deposits.

- Debt funds providing bridge and construction loans are quoting in the 7.75%-9.75% range, with rate floors providing a benefit to lenders if SOFR decreases as expected.

- Life company rates continue to hold in the 5.25% – 6.50% range with a focus on multifamily, retail, and industrial properties.

- CMBS volume remains low as wide spreads persist, hovering at +/-300 bps for most product types, putting all-in borrowing costs at 6.25% – 7.25%.

Click here to view the full report